When you apply for a mortgage loan, you’ll receive a standardized form called a loan estimate within three working days. The purpose is to give you the opportunity to compare multiple offers from lenders and to negotiate terms where applicable. Once you choose a lender, this pre-approval allows you to shop for a home with confidence, but keep in mind that the loan estimate is not a final approval, nor does it mean you’re locked into the loan.

How to Prevent Carbon Monoxide Poisoning in Your Home

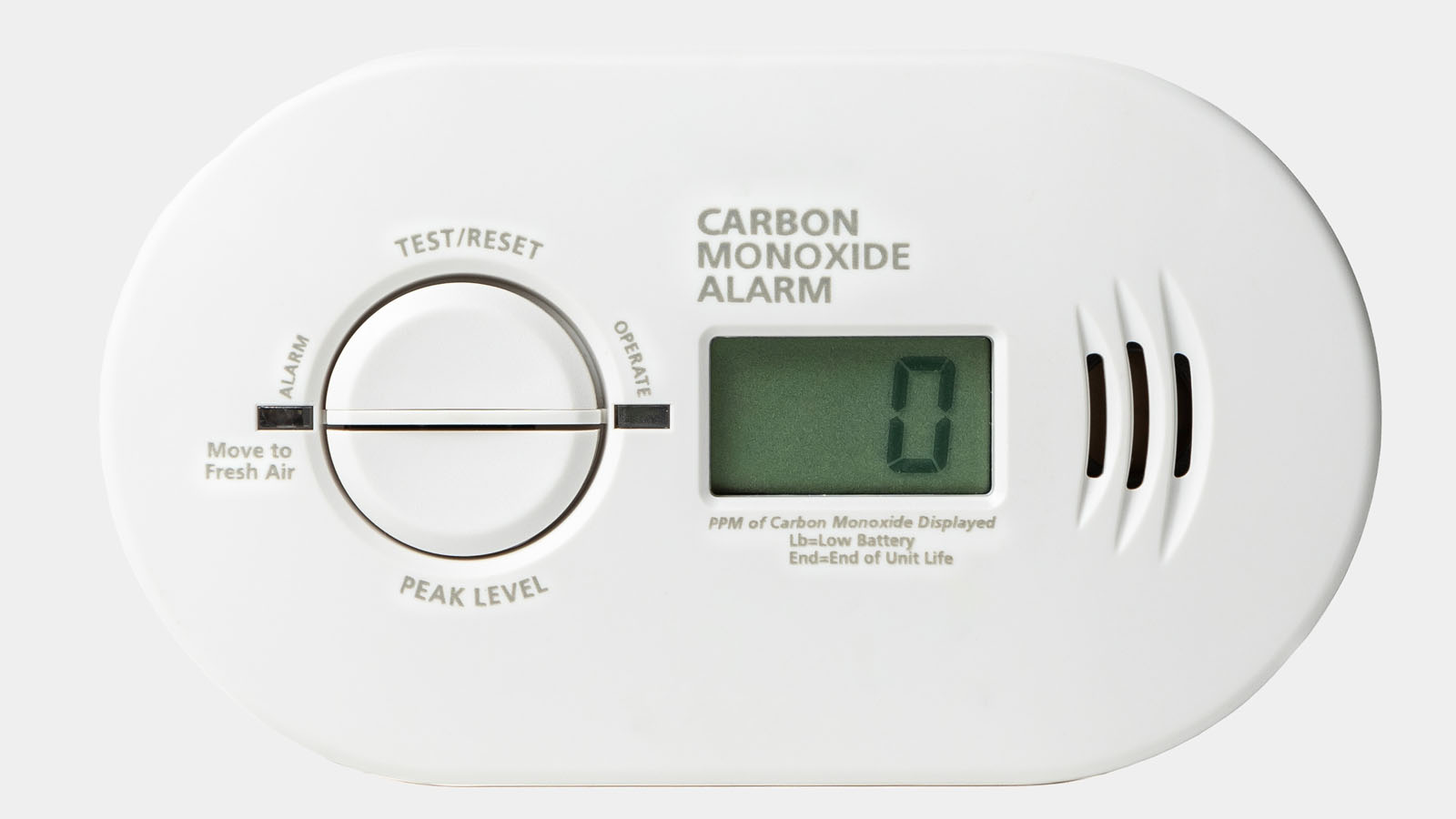

With fall and winter approaching, it’s a good time to have your home’s heating systems professionally inspected and serviced, according to the Consumer Product Safety Commission. A trained technician can check chimneys, central heat, gas heaters, heat pumps, electric heaters, and more to make sure the systems are working properly and not producing deadly carbon monoxide (CO). They can also install electrical or battery-operated CO detectors throughout the house to ensure the personal safety of all occupants.

Ready to Buy Your First Home? Get Certified to Unlock Financial Assistance

You may think you don’t need a first-time homebuyer’s certificate, but it’s a good idea to take a few hours to obtain one. A certificate shows you’ve completed educational requirements to prepare you mentally and financially to buy a home. Plus, completion of a course may make you eligible for some first-time homebuyer assistance or income qualified programs such as grants, down payment assistance, and zero interest loans.

A rain garden isn’t as complex an idea as it sounds. You can just use a small depression in your yard—the one where a puddle always forms when it rains. According to LifeHacker.com, the goal of a rain garden is to “temporarily hold and absorb rain water runoff coming from roofs, driveways, patios or lawns.”

Among the criteria that lenders use to determine your eligibility for a mortgage loan is your debt-to-credit (DTC) ratio. According to Equifax, one of three major credit reporting entities used by lenders, landlords, credit card companies, employers, and others, debt-to-credit is the amount you owe across all revolving accounts compared to the amount of revolving credit available to you. This is one component that comprises 30% of your total credit score, and it includes your payment history, how many credit accounts you’ve got and what types of credit they are.

For those who aren’t married, the housing market doesn’t have to pass you by: you and your significant other, best friend, family member, or business partner can purchase a home together as joint owners. Simply decide how you want to buy, use and, eventually, sell the property to determine what form of ownership goes onto the deed—as tenants in common, or as joint tenants with the right of survivorship.

Should You Make Repairs Before Listing Your Home for Sale?

In a fast-moving housing market, you may conclude that you don’t need to do much to sell your homes. But, selling a home “as is” may cost you more than you know.

House sizes have come a long way from 1973 when the average home was 1,660 square feet. The average in 2015 was 2,687 square feet, and since then home sizes have fluctuated, according to the economy, mortgage interest rates, and overall affordability. The question is – how much space do you really need?

Laminate vs Vinyl Flooring: Which One is Better for Your Home?

There are areas in your home that would be more practical, functional, and attractive if they were finished with the appropriate flooring, particularly high traffic areas like kitchens, playrooms, mudrooms, and laundry rooms.

While many potential homebuyers have been knocked out of the market by higher mortgage interest rates and home prices, there’s hope on the horizon that they’ll have better luck in 2024.

| Older Posts |